30+ writing off mortgage interest

In addition to itemizing these conditions must be met for mortgage interest to be deductible. Create Your Satisfaction of Mortgage.

Piecesofmepapercraft Etsy De

Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage.

. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million. Ad Developed by Lawyers. Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and.

Web If your adjusted gross income is greater than 100000 50000 if married filing separately the amount you may deduct will be ratably decreased and will be. 2000 Your total itemized deductions come out to 14500. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. Get Instantly Matched With Your Ideal Mortgage Lender. Web How to claim the mortgage interest deduction.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Look in your mailbox for Form 1098. Web There are a few stipulations you must meet to write off your mortgage interest on your taxes.

Lock Your Rate Today. In this case as a couple. LawDepot Has You Covered with a Wide Variety of Legal Documents.

Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. The average rate on the 30-year fixed mortgage jumped back over 7 Thursday rising to 71 according to Mortgage News Daily. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Your mortgage lender sends you a Form 1098 in January or early February. Web You cant deduct the principal the borrowed money youre paying back. Save Real Money Today.

When youre determining what. Closing costs typically range between 2 and 6 of your loan amount. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Web Mortgage interest Mortgage interest is tax-deductible for your rental property because its a business expense says Thomas Castelli a certified public accountant in Raleigh. The first is that you must itemize your taxes and that means not taking the. Web 2 days agoKey Points.

Ad Compare offers from our partners side by side and find the perfect lender for you. Ad Compare the Best Home Loans for March 2023. Web For example if you borrowed 250000 on a 30-year fixed-rate loan at 4 percent interest then paid 12000 in mortgage payments over the course of the year.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. However higher limitations 1 million 500000 if married. Web As of the beginning of 2018 couples who file their taxes jointly are only able to deduct interest on up to 750000 of eligible mortgages which is down from 1 million.

Web You can write off some mortgage closing costs at tax time. Apply Get Pre-Approved Today. Web Mortgage interest.

Drop In 10 Year Treasury Yield Mortgage Rates Is Just Another Bear Market Rally Longer Uptrend In Yields Is Intact With Higher Highs And Higher Lows Wolf Street

Westpac Nz Economists Raise Their Forecast Ocr Peak By 50 Basis Points Interest Co Nz

Mortgage Interest Deduction A Guide Rocket Mortgage

Paying Down A 30 Year Mortgage Faster Vs 15 Year Mortgage My Money Blog

Keeping Finances In Check 30 How Tos From Veteran Real Estate Agents Inman

The Home Mortgage Interest Deduction Lendingtree

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

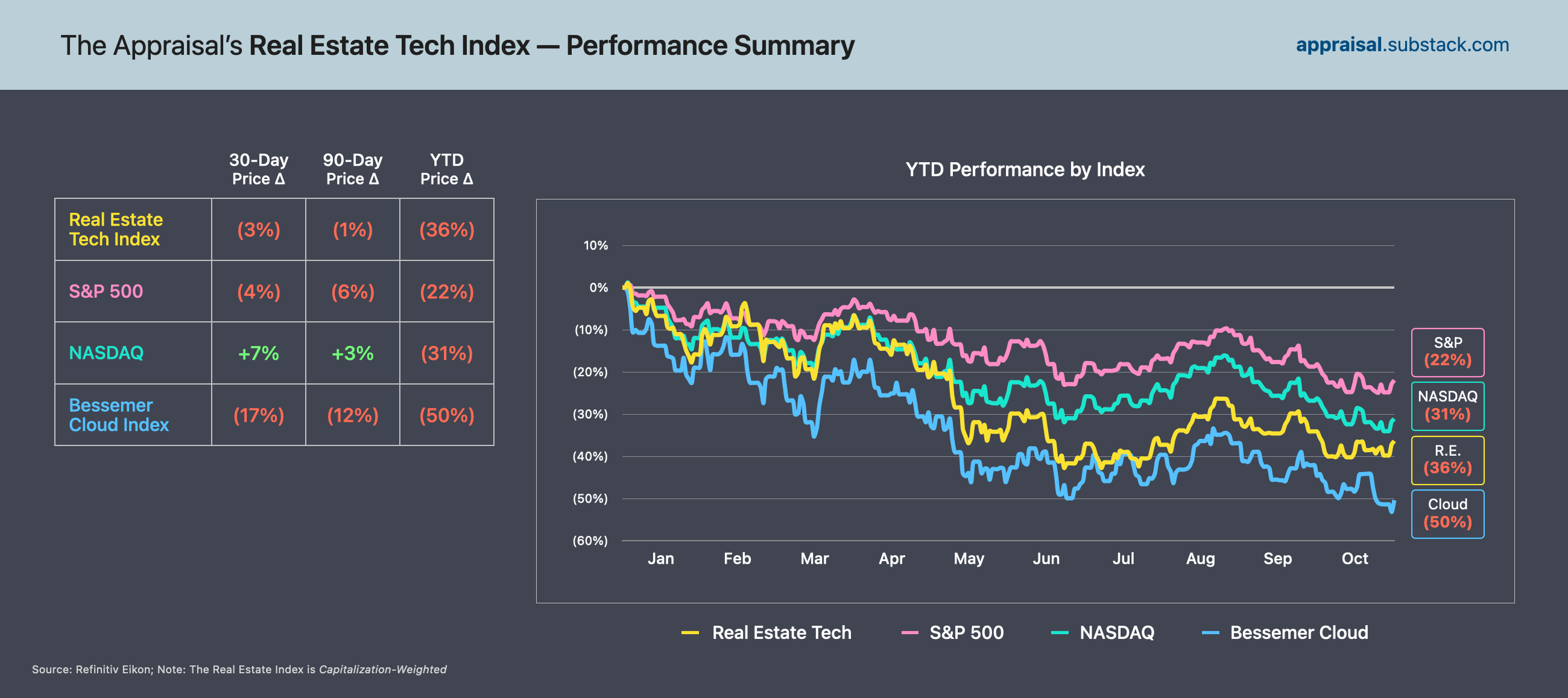

The Appraisal October 2022 Real Estate Tech Market Map Multiples Update

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Create A Loan Amortization Schedule In Excel With Extra Payments

![]()

Dpd 8ixofjdjmm

Daily Mortgage Report April 30 Ratespy Com

What To Do If Your Fixed Rate Or Interest Only Term Expire In 2023

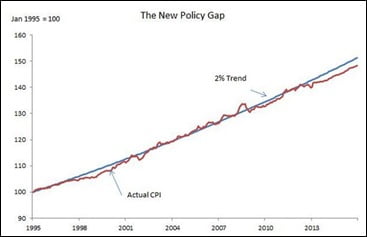

Inflation Control And Mortgage Rates Mortgage Rates Mortgage Broker News In Canada

A Guide To Mortgage Interest Deduction Quicken Loans

15 Year Vs 30 Year Mortgage Calculator Calculate Current 15yr Frm Or 30yr Monthly Fixed Rate Mortgage Refinance Payments

Breezeful Online Mortgage Broker Review February 2023 Finder Canada